1) Executive Overview

Use Case: Portfolio Optimization (Anonymized)

Business Line: Discretionary Portfolio Management (UCITS/AIF)

Model Type: Hybrid quant (factor model + heuristic rules) with GenAI advisor assist

Purpose: Improve after-fee risk-adjusted returns while meeting suitability constraints.

This sample shows how RiskAI dynamically maps WAM use cases to MiFID II, the EU AI Act, ISO 23894, NIST AI RMF, and ESMA/SEC/FCA guidance, auto-generating evidence (model cards, tests, approvals) to cut review cycles from weeks to days.

2) Policy → Procedure → Workflow

Client Suitability & Appropriateness

All AI-assisted recommendations must be demonstrably suitable to the client’s profile and risk tolerance; overrides documented.

POL-07Run Suitability Checks

Bind client profile, product risk, and rationale; capture advisor notes and e-sign off.

PROC-07-BSuitability — Recommendation

- Triggered: Pre-trade & portfolio change

- Outputs: Suitability PDF, rationale JSON, advisor e-sign

Best Execution & Conflict Management

Trading must evidence venue selection, price improvement, and conflict controls per policy.

POL-08Capture Execution Evidence

Archive input quotes, venue choice, outcome metrics; attach to trade.

PROC-08-ABestEx — Trade Binding

- Triggered: On trade

- Outputs: BestEx PDF, metrics JSON, conflict attest

3) Controls & Evidence Table

| Control ID | Policy | Procedure | Workflow | Regulatory Ref | Status | Evidence |

|---|---|---|---|---|---|---|

| POL-01 | Model Risk Classification | Model Tiering | Tiering — Intake | EU AI Act Art. 6; ISO 23894 5.3 | Implemented | EVID-101 |

| POL-07 | Suitability & Appropriateness | Run Suitability Checks | Suitability — Recommendation | MiFID II Art. 25; ESMA Suitability Guidelines | Implemented | EVID-207 |

| POL-08 | Best Execution & Conflicts | Capture Execution Evidence | BestEx — Trade Binding | MiFID II Art. 27; RTS 28 / best-ex policies | Implemented | EVID-308 |

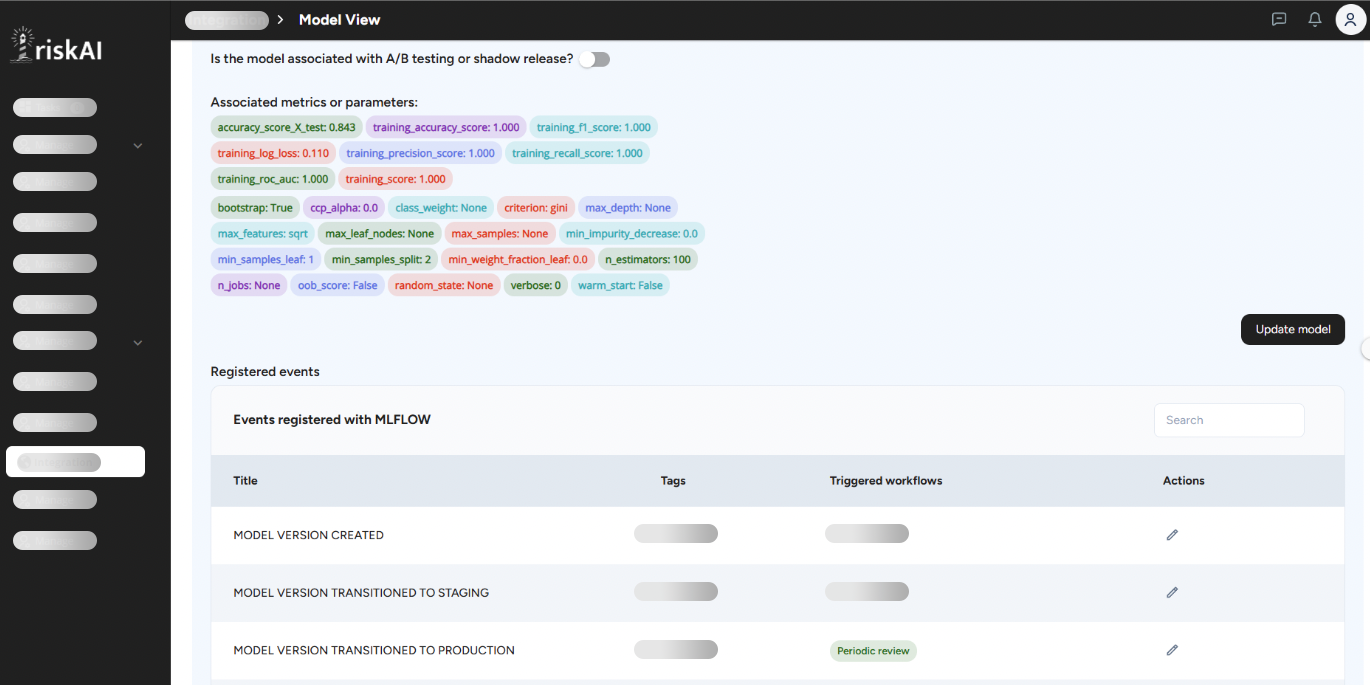

| POL-12 | Post-Market Monitoring | Monitor Drift & Incidents | Monitoring — Ops | EU AI Act Art. 61; NIST “Manage” | Implemented | EVID-512 |

4) Evidence Snapshots

EVID-101 — Model Register / Tiering (Intake)

Timestamp: 2025-07-08 10:42 UTC

User: quant.lead@wam.example

Result: Tier = High Risk (Investment decisions)

Artifacts: JSON intake, owner sign-off

EVID-207 — Suitability Check (Pre-Trade)

Timestamp: 2025-07-12 09:14 UTC

User: advisor@wam.example

Result: PASS — portfolio within client risk band

Approvals: Advisor e-sign ✔; Compliance spot-check ✔

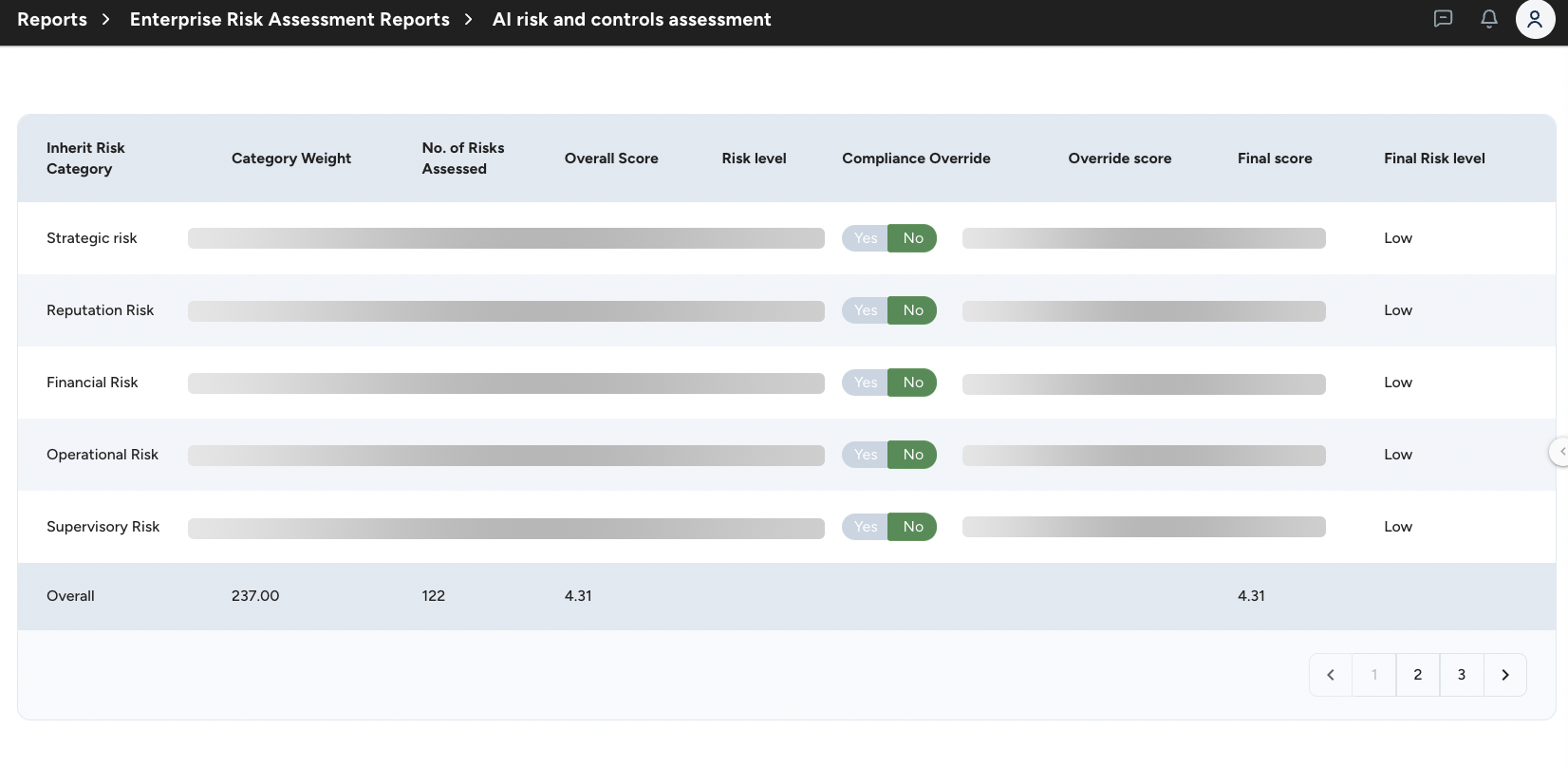

EVID-512 — Controls Assessment

Signal: Factor drift (value tilt ↑ beyond threshold)

Action: Escalated per runbook; re-opt request opened

Outcome: CAPA logged; guardrail adjusted

5) Regulatory Mapping (Excerpt)

MiFID II / ESMA (Suitability, BestEx, Conflicts) • Art. 25 Suitability → POL-07 (Suitability), PROC-07-B (Checks) • Art. 27 Best Execution → POL-08 (BestEx), PROC-08-A (Evidence) • Conflicts Mgmt → BestEx attestations & surveillance EU AI Act • Art. 6 Risk tiering → POL-01 (Model Register & Tiering) • Art.14 Human oversight → Approvals & overrides bound to artifacts • Art.61 Post-market monitoring → POL-12 (Monitoring — Ops) ISO 23894 / NIST AI RMF • 5.3 Risk assessment; Govern–Map–Measure–Manage alignment

Appendix: Workflow Definitions

Trigger: Before recommendation or portfolio change

Inputs: Client profile (KYC, risk rating), product risk, constraints

Steps: Check fit → create rationale → advisor notes → e-sign → archive

Outputs: Suitability PDF, rationale JSON, signatures, audit log ID

Trigger: On each trade

Inputs: Quotes, venues, algos, conflict flags

Steps: Venue selection → execute → capture metrics → archive

Outputs: BestEx PDF, metrics JSON, conflict attest, audit log ID

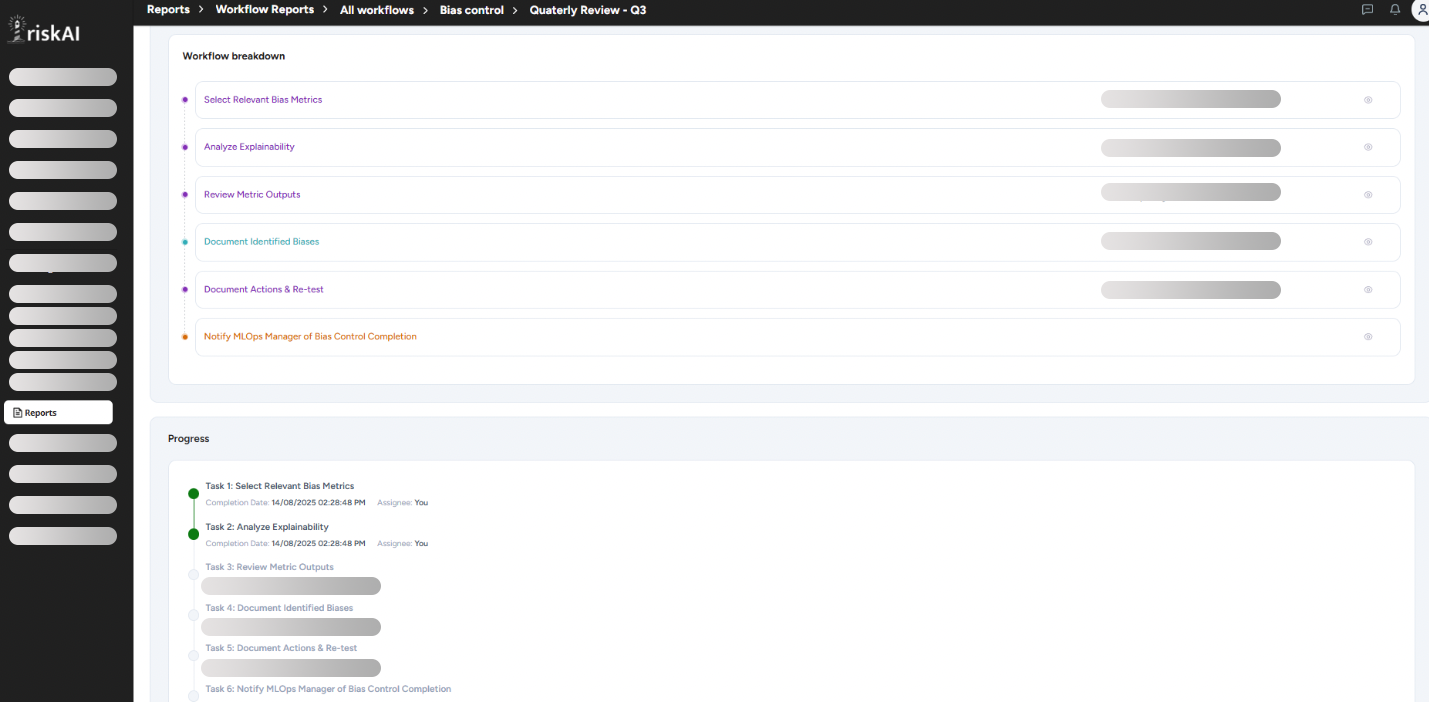

Trigger: Scheduled & real-time

Signals: Drift (factors/risk), bias, data quality, conflicts, incidents

Outputs: Alerts, incident record, CAPA, audit log ID